Despite the infrastructure, framework and technology available for quite some time now, car manufacturers have been hesitant to offer the option of buying their cars online.

At a time now when all businesses need to adapt to the new normal thanks to coronavirus, car salespeople are being caught out in the traditional dealership landscape and are making it increasingly difficult for consumers to get what they need.

The situation is at odds with current trends which show right now could be a good opportunity to purchase a car, thanks to generous government tax write-offs, looming end of year sales and general discounting to combat a free falling economy in which new cars sales are severely affected.

Almost everything else is available to purchase online with buy-it-now convenience, ready to be dropped right at your doorstep – but why is it taking so long for cars to get this treatment?

Online car sales aren't new

Some have dipped their toes into the online market space, like Subaru and Toyota, who offered the BRZ and Supra sports cars via online portals in 2012.

Subaru regards the initial online offering of 200 of its BRZ units as a resounding success, with Subaru Australia public relations manager David Rowley saying at the time the demand caused their website to crash.

“All information was available online, and we offered a national drive-away price on the car,” he explained.

“We also had a dedicated customer support base here to regularly update the customer.”

It was the kind of experiment that allowed Subaru to further expand its niche by offering to sell other cars through its website and introduce a number of shopping centre-based experience centres.

FCA is scrambled to offer online buying services to COVID-19-stricken Italy, where dealers are using Google Hangouts to meet with prospective customers as opposed to meeting them in traditional dealerships.

Customers could speak to dedicated sales consultants who can help them specify a new car from the comfort of their own home. They can receive quotes, understand financing options and even negotiate a sale over the videoconferencing software – although signing on the dotted line and paying must be done in person.

It mightn’t be the optimal solution as it still opens up face-to-face contact in a time where that sort of interaction must be curbed, but at least FCA is trying alternative ways to do things in Italy. It is said that the process will be expanded elsewhere in due course.

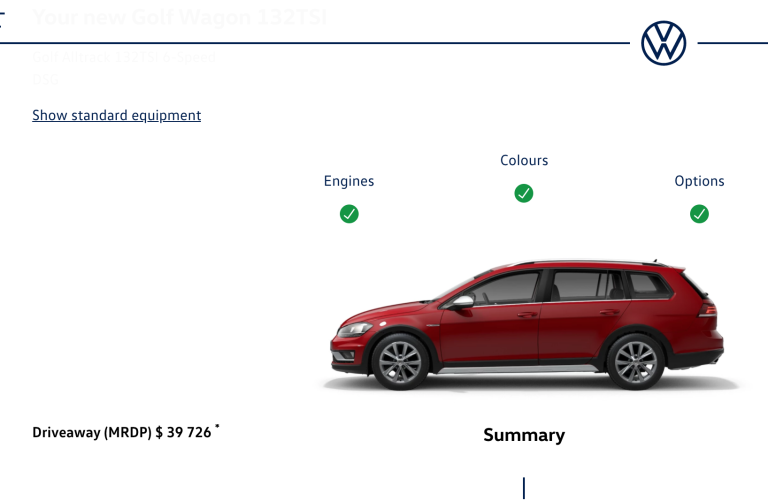

Volkswagen Australia has recently jumped on board too with what they’re calling ‘online ordering’. Customers are able to specify and leave a refundable $500 deposit for a car, whereby the designated dealer then makes contact within 48 hours to complete the purchase and source the car.

It's not only the built-to-order stuff, too. A Stock Locator tool lists all new stock that Volkswagen has in its inventory, and deposits are able to be submitted for those cars.

They’ll even provide an online estimate of what they’re willing to pay for trade-ins.

After one month of its online sales portal, VW has reported 1000 extra leads that it ordinarily would have missed with the traditional dealership sales model.

Which car brand leads the way online?

Another brand that arguably has the greatest hold on futuristic online automotive sales is the brand that manufactures futuristic cars themselves – Tesla.

Tesla has used the internet to sell cars online ever since it first arrived in Australia, only intending its few physical dealerships for servicing, teaching and product handovers.

In fact, believe it or not, Tesla won’t actually sell you a car unless it's online. Walk into a Tesla dealership and you’ll find interested parties being shown how to order cars using in-store computers or their own device.

.jpg)

Forget about test drives and in-situ product learning for the moment, but customers are easily able to place an order for a car online – whether it be a demo model or one built from scratch – and only have to visit a physical dealership once the car arrives and pick it up.

Tesla was also quick to introduce ‘zero-touch’ delivery policies in the US where cars are left in a location of your choice for you to unlock using a Tesla phone app.

Paperwork is left inside the car for buyers to complete and send back with the included pre-paid envelope.

If combined with Tesla’s traditional online method of selling its cars, you could feasibly order, pay for and take delivery of a car without interacting with another person.

BMW has just revealed a new online sales portal called BMW Shop that can source current stock which shoppers can pick and reserve at driveaway prices. While you can't order new from factory yet, a price quotation is given with an enquiry on local stocks, and a video chat can be set up to discuss the specifics.

Toyota dealerships have had the ability to sell online for over a year, a process that Toyota says is becoming increasingly popular.

"Looking at 2020 specifically, we have seen a slight increase ... in online sales. This could be attributed to COVID-19, as our online platform enables our customers to purchase their next vehicle from the comfort of their home," a Toyota spokesperson told WhichCar.

But are buyers ready for this kind of online buying process?

Surveys carried out over the past few years have shown that about a third of Australians are ready to buy a car from a virtual showroom sight unseen. But a recent survey by online financial brokers Savvy Finance suggests it will take some time to convince the remaining 70 percent.

According to the survey of 1001 people, 70 percent said they were 'uncomfortable' about home-facilitated test drives, virtual demonstrations, remote payments, and dealer delivery, with more than half of them saying they were "extremely uncomfortable'. Just 4.0 percent of the people surveyed said they were 'extremely comfortable' with the idea.

“It seems we’re not quite there yet when it comes to buying big assets like cars online,” said Savvy's managing director. Bill Tsouvalas. “We don’t want to buy a car sight-unseen, but we are still in the market for cars and vehicles in general.

Tsouvalas says that hesitancy to purchase a car online has contributed to Covid-19 having a bigger impact on vehicle sales in 2020 than it needed to.

"Work From Home doesn’t seem to have made much of a dent in consumer sentiment – but the fact many aren’t prepared to take a leap of electronic faith has.”

According to Toyota the feedback from buyers who have taken the leap has been "overwhelmingly positive" for both the online experience and the in-store pickup.

It’s a process that worked out for the Tesla Owner’s club president Mark Tipping who ordered his Model S P85D online more than five years ago.

“I had no one pressuring me, which was what I liked most” he told WhichCar. Other positives Mark notes was the fact “that the price was the price, everyone gets the same deal which is absolutely transparent.”

"A product specialist was on hand if I needed updates and I called up mid-way through the build process to check-in, but the overall experience was refreshingly easy.”

When asked if the same process could be adopted by other manufacturers, Mark wasn’t as enthusiastic. “It’ll be a challenge to others who might have to introduce a hybrid system (online and in-person) to keep all parties happy," he said.

"The customer also may not be ready for it so there’ll have to be a huge amount of marketing around it too.”

Car buyers mightn't have any other choice but to buy their cars online in the near future. Social distancing measures are preventing more and more businesses from operating day-to-day, and if more restrictions are on the way it's likely dealerships themselves will have to shut up shop.

Of course, there are hurdles to overcome before we all jump on board with buying online. For example, there are those who value the process of haggling, the signing of paperwork and how is the specific value of a trade-in determined? That said, those hurdles aren't insurmountable.

For the time being, if manufacturers can start introducing a complementary online method to a traditional dealership sales model that may allow some customers to start thinking again about buying a car during a time in which that may be the furthest thing from their mind.

COMMENTS